Decline in Exports and Increase in Chinese Imports Worry Footwear Manufacturers

August’s performance was strongly affected<...

.jpg)

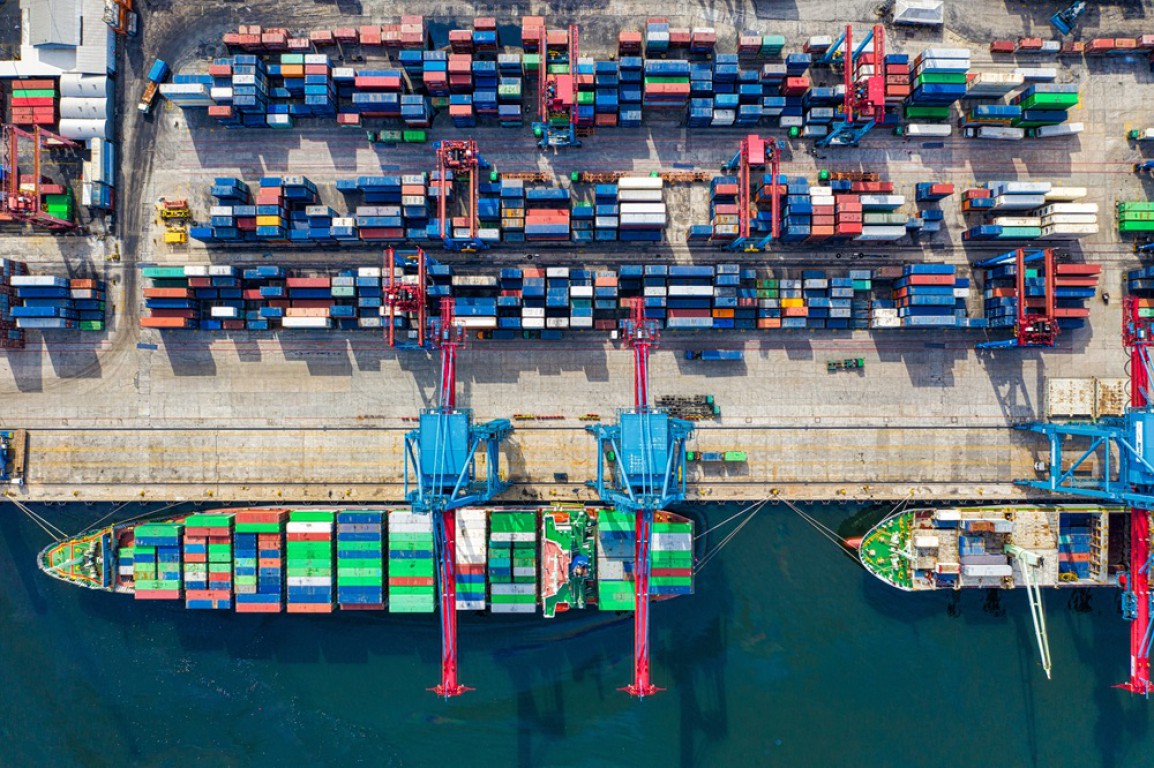

Data compiled by the Brazilian Footwear Industries Association (Abicalçados) in August reveal alarming figures for the sector. While exports continue to decline—now further impacted by the 50% tariff imposed on Brazilian products in the United States—imports are on the rise, particularly those coming from China.

In August, footwear exports totaled 7.64 million pairs, generating US$ 77 million—representing declines of 0.5% in volume and 9.1% in revenue compared to the same month last year. Over the first eight months of the year, 67.52 million pairs were shipped abroad for US$ 651.1 million, reflecting a 5.7% increase in volume but a 0.6% decrease in revenue when compared to the same period in 2025..

August’s performance was strongly affected by results in the United States, the main international destination for Brazilian footwear. In the eighth month of the year, exports to the U.S. reached 803.7 thousand pairs and US$ 21.4 million, representing declines in both volume (-17.6%) and revenue (-1.4%) compared to the same month in 2024. Year-to-date, shipments to the U.S. totaled 7.7 million pairs and US$ 156.3 million, reflecting increases of 10.7% in pairs and 5.8% in revenue compared to the same period in 2024. “The tariff imposed by the United States—a country that accounts for more than 20% of all Brazilian footwear exports—was already felt in August. In September, when we will have a full month under the additional tariff, the setback is expected to be even greater,” laments Abicalçados’ Executive President, Haroldo Ferreira. According to him, the tariffs make Brazilian exports “virtually unviable” when faced with fierce competition from Asian suppliers, especially the Chinese, in that market.

The second-largest destination for Brazilian footwear this year is Argentina, which in August imported 1.63 million pairs worth US$ 18.44 million—representing increases of 68% in volume and 11.6% in revenue compared to the same month last year. Year-to-date, exports to the country reached 9.35 million pairs, generating US$ 135.68 million, growth of 37.4% in volume and 5.3% in revenue compared to the same period in 2024.

Paraguay ranks third among the main destinations for Brazilian footwear abroad. In August, the country imported 876.9 thousand pairs from Brazil for US$ 4.3 million, increases of 41.4% in volume and 23.5% in revenue compared to the same month last year. Year-to-date, Paraguayan imports reached 5.95 million pairs and US$ 27.7 million, reflecting an 8.7% increase in volume but a 1.7% decrease in revenue compared to the same period in 2024.

Among Brazil’s leading footwear-exporting states year-to-date are Rio Grande do Sul, with 21.4 million pairs and US$ 315 million—an increase of 1.1% in volume but a 4% decline in revenue compared to the same period last year; Ceará, with 21.33 million pairs and US$ 127.73 million—an 8.4% increase in volume but a 5% drop in revenue; and São Paulo, with 4.73 million pairs and US$ 68.2 million—representing increases of 26.5% in volume and 18.6% in revenue.

Chinese Invasion

With imports on the rise, Abicalçados highlights the surge of Chinese footwear entering the country. “With the tariff imposed by the United States on Chinese products, producers from that country have been redirecting their surpluses to other markets—including Brazil—at very low prices,” explains Ferreira, emphasizing that this situation creates an uneven competitive environment in Brazil’s domestic market, causing losses for the national industry.

In August alone, 492 thousand pairs of Chinese footwear entered Brazil, worth US$ 3.7 million—an increase of 41.5% in volume and 67.2% in revenue compared to the same month in 2024. Year-to-date, imports from China totaled 8.45 million pairs and US$ 31.18 million, representing increases of 9% in volume and 14.1% in value compared to the same period last year.

In total, footwear imports in August reached 3.55 million pairs and US$ 49.27 million—an increase of 23% in volume and 18.4% in revenue compared to the same month in 2024. Year-to-date, imports totaled 30.13 million pairs and US$ 387 million, reflecting growth of 26.9% in volume and 28.8% in revenue compared to the same period last year.

-thumb.jpg)

-thumb.jpg)

-thumb.jpg)